The Malaysian government is accelerating its push towards green mobility by offering comprehensive tax exemptions and incentives for electric vehicles (EVs). These initiatives are part of a broader strategy to develop the EV ecosystem, support local automotive manufacturing, and encourage more Malaysians to adopt clean energy transportation.

Below is a detailed guide to all current EV tax exemptions and incentives in Malaysia, effective until 2027 and beyond.

What EV tax exemptions are available in Malaysia?

1. Income Tax Relief for Individuals

Malaysian taxpayers can claim up to RM2,500 per year for:

- Installation of EV charging facilities at home

- Subscription to EV charging services

- Valid for the assessment year up to 2027

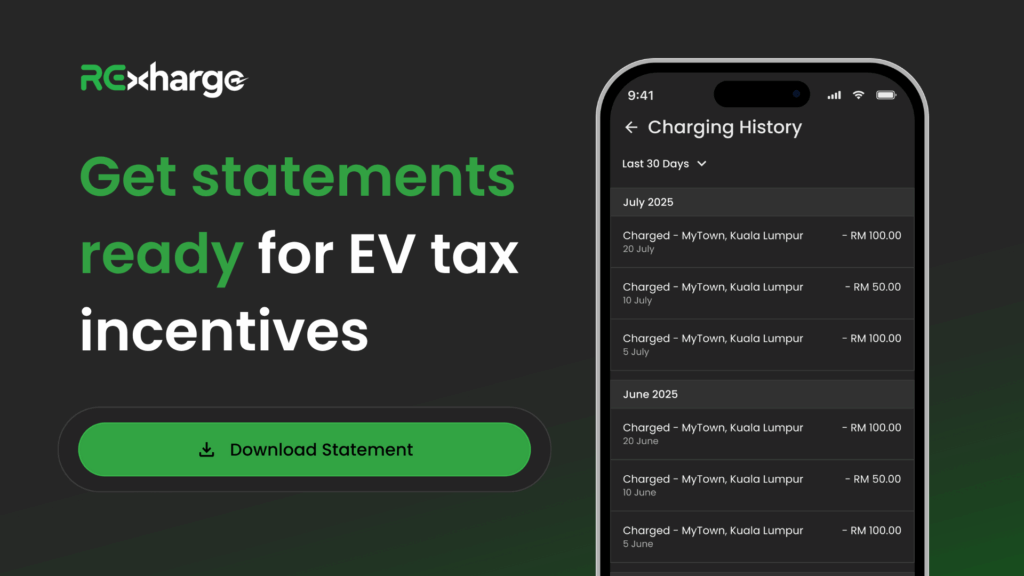

(Important note: Users may look forward to the RExharge App Version 2.0, which introduces a new Invoice Generation feature, allowing users to easily create and download statements directly from the app.)

2. Road Tax Exemption (ending 31 December 2025)

All EV users in Malaysia are entitled to a road tax exemption only until the end of 2025.

- Covers electric cars, motorbikes, and commercial EVs.

- Aims to reduce ownership costs and encourage nationwide adoption.

3. Import and Excise Duty Exemptions

- Completely Built-Up (CBU) imported EVs: Full exemption from import and excise duties until 31 December 2025.

- Locally assembled (Complete Knocked Down – CKD) EVs: Full exemption from import and excise duties, as well as sales tax, until 31 December 2027.

This reduces the retail cost of EVs, making them more affordable to Malaysian consumers and businesses.

4. Incentives for EV Manufacturers and Investors

To boost local EV production, the government provides several incentives:

- Pioneer Status or Investment Tax Allowance: For companies manufacturing Energy Efficient Vehicles (EEVs), EVs, or critical components.

- Green Investment Tax Allowance (GITA): Charging Point Operators (CPOs) that meet eligibility criteria enjoy a 100% Investment Tax Allowance for five years.

- Income Tax Exemption for EV Charging Equipment Manufacturers:

- 100% income tax exemption on statutory income from 2023–2032.

- 100% Investment Tax Allowance for five years, applicable to qualifying capital expenditure (QCE).

- Unabsorbed allowances may be carried forward until fully utilized.

- 100% income tax exemption on statutory income from 2023–2032.

Eligibility Criteria for EV Manufacturers

To qualify, companies must:

- Be incorporated under the Companies Act 2016.

- Hold a Manufacturing Licence from MITI or exemption approval from MIDA.

- Ensure at least 80% Malaysian full-time employees.

- Maintain a minimum 20% value-add in products.

- Employ at least 15% science and technical staff.

- Collaborate with local vendors, provide internships, and contribute to talent development in EV-related fields.

Development of EV Ecosystem in Malaysia

The government is not only focusing on tax incentives but also building infrastructure to support EV adoption:

- 10,000 EV charging bays nationwide by 2025.

- Establishment of EV interoperability and testing centres, including the NxGV Test Centre and National Rechargeable Battery Testing Centre.

- Development of EV-related standards: charging systems, battery disposal, swapping technologies, and wireless charging.

- Expansion of incentives for EV adoption, such as free parking and waived tolls in selected areas.

Why Tax Exemptions Matter

- Lower EV Ownership Costs – Import, excise, and road tax exemptions significantly reduce the upfront cost of buying and maintaining EVs.

- Boost to Local Industry – Manufacturing incentives encourage more local companies to invest in EV and component production.

- Environmental Benefits – Greater EV adoption reduces carbon emissions and supports Malaysia’s commitment to a greener economy.

- Job Creation – Incentives for manufacturers will create opportunities in R&D, engineering, and technical sectors.

Conclusion

Malaysia’s comprehensive EV tax exemptions and incentives reflect the government’s commitment to transforming the automotive industry and supporting sustainable mobility. With exemptions lasting until 2025–2027 for users and up to 2032 for manufacturers, now is the best time for individuals and businesses to explore EV adoption.

By combining tax savings, lower running costs, and expanding infrastructure, Malaysia is paving the way for a cleaner, smarter, and more competitive EV future.

Recharge Xolutions – One-stop EV Charging Solutions

Looking for EV charging experts in Malaysia? Recharge Xolutions provides A-Z solutions for all types of EV charging: residential, commercial, and industrial! Contact us on WhatsApp for a free consultation.