Table of Contents

Why will Tesla prices in Malaysia increase after 31 December 2025?

End of CBU EV tax exemptions

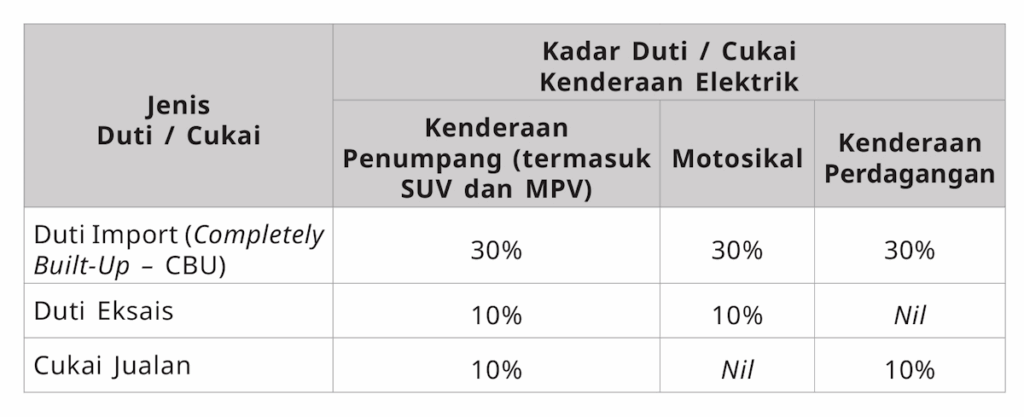

Fully built-up (CBU) EVs in Malaysia currently enjoy excise-duty and import-duty exemptions, but these will end on January 1, 2026. In 2026, a 30% import tax, 10% excise tax and 10% SST will be imposed on CBU EVs.

Once those exemptions are removed, the cost of taxes will be passed on to the buyer, raising the effective selling price.

Is the Tesla price increase confirmed?

While the end of tax exemptions on CBU will impact the prices of imported cars including Tesla, there are still some factors that will influence how drastically the prices will increase.

Tesla quotes RM20,000 in savings if you book by 31 December 2025

Tesla has advertised “a minimum of RM20,000 in savings” if buyers book now, meaning it anticipates prices rising by at least that amount in 2026.

Do note that the company reserves the right to change its listed prices at any time on its website.

That gives Tesla leeway to adjust pricing in response to cost pressures (e.g. higher taxes, import costs, currency fluctuations, etc.).

MITI is still in discussions for new initiatives

While a price increase for imported EVs is for certain, there might be some hope for its prices to be adjusted in the future as MITI mentioned they are discussing to find new initiatives to mitigate effects of the hefty taxes.

In a report by the EDGE, Investment, Trade and Industry Minister Tengku Datuk Seri Zafrul Abdul Aziz said discussions are ongoing to identify new initiatives that could support electric vehicle (EV) adoption once excise duty exemptions for completely built-up (CBU) EVs end in 2026.

He explained that talks between the Ministry of Investment, Trade and Industry (MITI) and the Ministry of Finance (MOF) are still in progress, but no specific incentive proposals have been tabled so far.

“There are ongoing discussions with the MOF, but no proposals have been made yet,” he told Bernama on the sidelines of the 10th ASEAN-Organisation for Economic Co-operation and Development (OECD) Good Regulatory Practice (GRP) Network meeting.

Conclusion: Should you buy a Tesla before 31 December 2025?

If you have done your due research on which vehicle fits your needs the most, then it is best to confirm your Tesla purchase now before 31 December 2025 to still be eligible for the tax exemption.

If you are still on the fence on which car to purchase, you can wait for any further announcements from MITI for any new initiatives. However, please note that this is still in the discussion stage.

Alternatively, you could explore CKD EVs which are still tax exempted until 2027. If you explore CKDs, you will be contributing to the growth of Malaysia’s automotive industry and support local employment opportunities.

Recharge Xolutions can install your Tesla charger at a competitive price

If you have made up your mind to purchase a Tesla, congratulations on your new journey! If you are looking for an experienced EV charger installer with ST and TNB licensing as well as comprehensive after-sales service, do consider Recharge Xolutions. Just WhatsApp us for a free consultation!